The U.S. coworking space market is constantly evolving and adjusting to consumer preferences, technology breakthroughs and changing work trends. In this way, coworking spaces are essential for offering creative solutions that satisfy the needs of both individuals and enterprises as the nature of work continues to change and places more focus on flexibility, collaboration and remote connectivity.

This is why we keep an eye on the development of the coworking industry, as seen through the flex workspace inventory, the square footage attributed to it, coworking prices and top operators. Accordingly, we looked into this data for the first quarter of 2024 and compared it to the previous numbers registered in Q4 of 2023 to determine the industry’s evolution across the top 25 markets in the U.S.

National Coworking Supply Continues Upward Trajectory With Substantial Increases of up to 15% in Salt Lake City

While the national coworking inventory stood at 6,251 at the end of 2023, the first quarter of 2024 registered an impressive 6% growth, which translated to 346 more coworking spaces throughout the country. This puts the current national supply at precisely 6,597 spaces and demonstrates a constant and positive expansion of the sector.

Specifically, 20 of the 25 top markets logged more coworking spaces in Q1 of 2024, in some cases by a notable number. For instance, 15% more flex workspaces were added to Salt Lake City’s inventory, putting it at a total of 71 in April, whereas other markets — like Minneapolis-St. Paul and San Diego —increased their coworking supplies by 13% and 12%, respectively, in the span of three months.

Otherwise, only one-fifth of the leading U.S. markets registered declines in their numbers of coworking spaces with the steepest one of 8% (10 fewer spaces) in the Bay Area. That said, the remaining four — Manhattan, Washington, D.C., Miami and Philadelphia — each decreased by a minor 1%.

Rates for Virtual Offices & Open Workspaces Stabilize in Q1 of 2024, Dedicated Desks Go Down in Price

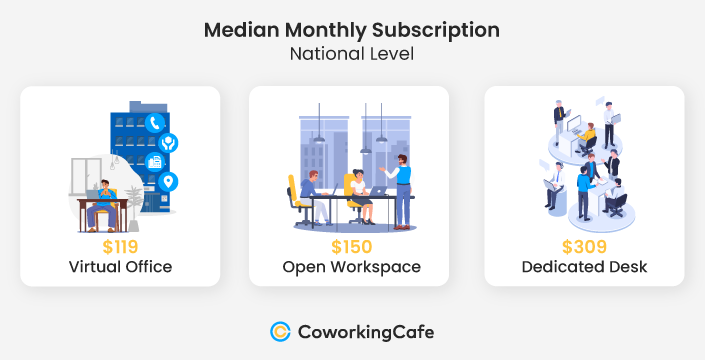

Coworking prices at the beginning of 2024 remained relatively stable with the only notable change registered in terms of dedicated desks. Similarly, virtual offices maintained the same median rate on a national level as it was in Q4 of 2023 at precisely $119 per month. In this case, four of the top 25 markets registered more affordable prices for virtual office subscriptions below the $100 mark. For instance, Dallas-Fort Worth, Denver and Brooklyn each stood at the median price of $99. And, as seen in previous quarters, Washington, D.C. topped all other markets in terms of affordable virtual offices at only $79 per month — $1 less than in 2023.

Coworking prices at the beginning of 2024 remained relatively stable with the only notable change registered in terms of dedicated desks. Similarly, virtual offices maintained the same median rate on a national level as it was in Q4 of 2023 at precisely $119 per month. In this case, four of the top 25 markets registered more affordable prices for virtual office subscriptions below the $100 mark. For instance, Dallas-Fort Worth, Denver and Brooklyn each stood at the median price of $99. And, as seen in previous quarters, Washington, D.C. topped all other markets in terms of affordable virtual offices at only $79 per month — $1 less than in 2023.

Conversely, other markets stood well above the national median with rates that approached the $200 mark. Namely, in New Jersey, a virtual office subscription would set coworkers back $199/month, while the rate for the same type of service stood at $195 in Chicago. Even so, both of these markets saw price decreases since Q4 of 2023, when they each stood at $205.

Meanwhile, the median rate for open workspaces across the U.S. went up in price by just $1 in Q1 of 2024 as compared to the previous quarter to stand at $150 per month. Yet, despite the minor change in the national rate, the surge for open workspaces was significant in some markets. More precisely, the Manhattan and Brooklyn rates were almost double the national median at $299, after previously standing at $225 and $255, respectively. What’s more, an even larger difference was registered in San Francisco, which reached the same $299 mark for open workspaces. For comparison, at the end of 2023, it rested at $200. Likewise, five other markets almost reached the $200 mark with median monthly rates of $199 — Washington, D.C., Boston, Seattle, Miami and Austin.

At the same time, five other top markets landed at the opposite end of the spectrum with open workspaces that were significantly more affordable than the national median: in Q1 of 2024, the rates for this type of coworking arrangement in Philadelphia stood at $120, while New Jersey, Phoenix, Salt Lake City and Indianapolis all logged monthly median prices of only $119. In fact, in some cases (like Salt Lake City and Indianapolis), the median actually went down in price since the end of 2023.

Notably, the national median rate for dedicated desks was the only one to register a notable decrease quarter-over-quarter: although the rate stood at $322 in Q4 of 2023, it dropped to $309 this year with markets such as Indianapolis, Salt Lake City and even Chicago logging lower prices of $209 (Indianapolis) and $269 (Salt Lake City and Chicago).

However, on the opposite end, some leading markets registered significantly higher prices for dedicated desks. In this respect, Manhattan was the only one to surpass the $500 mark at $510 per month, which was still a $10 drop since the end of last year. Following close behind was Brooklyn, with $455, as well as San Francisco, which rested at $450. Two other markets also registered subscriptions of more than $400 in this category — Miami and Austin.

For more insights on coworking prices on a metro level, take a look at the subscription prices analysis for 2024.

Leading Markets by Number of Coworking Spaces

Gap Between Los Angeles & Manhattan Continues to Widen, LA Leads Nation in Terms of Coworking Spaces

Manhattan and Los Angeles continue to go neck-and-neck in the race for flex workspaces. Even so, the gap between the two leading markets widened more in Q1 with LA logging 270 coworking spaces, while Manhattan claimed 263. This was due to LA’s slight 1% increase in Q1 of 2024 and Manhattan’s 1% decrease in that period after the same pattern was seen in the previous quarter, too. Until Q4 of 2023, Manhattan was the ultimate leader in the nation. Then, at the end of last year, LA surpassed it (albeit, by just one coworking space) and now it continues to grow its inventory and put more distance between itself and Manhattan.

Other markets that decreased their inventories in Q1 were Washington, D.C., New Jersey and Philadelphia, each by an almost negligible 1%. The only other drop in inventory and the most significant one was seen in the Bay Area’s case — an 8% drop, setting the market back by exactly 10 coworking spaces from 133 at the end of 2023 to 123 in Q1 of this year.

However, the vast majority of the top U.S. markets registered healthy growth in their coworking inventory — which, in cases like Salt Lake City’s, increased 15% Q-o-Q. Not to be outdone, Minneapolis-St. Paul experienced 13% growth which took it from 85 spaces to 96, while San Diego saw a 12% surge in coworking supply to go from 108 spaces in Q4 of 2023 to 121 as of now. In the same way, Phoenix and Nashville also grew their inventories by 11%, while Seattle saw an increase of 10% in the span of three months.

Leading Markets by Square Footage

Nearly Two-Thirds of Top Markets Grow in Total Coworking Square Footage, Indianapolis Expands by 13% Since Last Quarter

On a national level, the total square footage attributed to coworking spaces has grown once again by another 3% in the past quarter to claim 124,792,346 square feet. For reference, this number stood at 113,742,866 at the beginning of 2023, which makes it easy to see the ongoing evolution of coworking across the nation. Moreover, the current total square footage represents 1.8% of the total office space in the U.S.

Similarly, during the first quarter of 2024, 15 of the top 25 markets registered increases in their total coworking square footage. In particular, Indianapolis led with an impressive 13% rise in coworking surface to reach 1.54 million square feet of coworking spaces. Following close behind with a 12% rise was San Diego, where 2.03 million square feet belonged to flex workspaces. Three other markets also grew their coworking ground by 9% throughout the course of only three months — Denver (3.66 million square feet), Nashville (1.76 million square feet) and Minneapolis-St. Paul (1.66 million square feet).

Conversely, the 10 areas where the coworking market decreased in Q1 saw rather minor changes with the most significant one (-6%) being registered in Brooklyn, N.Y. Apart from that, the remaining drops in total square footage ranged from only -0.01% in Atlanta to -3% in Chicago.

Notably, despite losing 1% of its coworking surface and having fewer spaces than LA, Manhattan still led in terms of coworking surface with a remarkable 12.55 million square feet — double that of the runner-up Los Angeles, where the coworking space inventory covers 6.47 million square feet. Washington, D.C. followed with the third-highest square footage covered by coworking at 6.12 million. Then, Chicago and Dallas-Fort Worth rounded out the top five with 6.1 and 5.13 million square feet of coworking, respectively.

Despite Surge in Total Coworking Surface, Majority of Markets Register Decreases in Average Square Footage

While the total national square footage continues to grow, the average square footage of individual coworking spaces in most markets is declining, following last year’s trend. As such, in Q1, the average square footage registered a 2% decrease compared to the previous quarter, dropping from 19,331 square feet per market to 18,917. Moreover, 18 of the top 25 markets decreased their average square footage. However, given that the total coworking inventory — as well as the total square footage — is on the rise in most markets, this average shows a focus on smaller coworking spaces across the nation.

The leading market in this category was Manhattan with a massive 47,727 square feet of coworking spaces, followed by San Francisco, which reached 27,969 square feet. In the previous quarter, the runner-up was Manhattan’s neighboring Brooklyn, which now stands in third place after decreasing its average square footage by 7% in the last three months.

Otherwise, the markets that increased their coworking square footage in Q1 were led by the Bay Area, where 7.6% of new coworking surface was added to its inventory. Miami was next in line with a 6% increase, while Indianapolis’ average coworking square footage grew by 5% in the span of three months. A 2% surge was also seen in Dallas-Fort Worth, as well as a 1% rise in Manhattan and Denver with a minor 0.2% growth in San Francisco.

Conversely, the most significant drops in average square footage were in Phoenix (-9%) and -8% in Salt Lake City. In Utah’s market, the interest in smaller coworking spaces becomes clearer as Salt Lake City saw notable growth in both the number of locations and the total square footage, but dropped its average surface covered by shared workspaces.

Distribution of Top Coworking Operators

HQ Increases Portfolio by 17% in Leading Markets, Continues to Solidify Place Among Top U.S. Operators

The top leading coworking operators in the U.S. market remained the same as they were in Q4 of 2023: Regus, WeWork, Industrious, Spaces and HQ. All of them logged the highest numbers of coworking spaces both on a national level (a cumulated Q-o-Q increase of 2%) and within the top 25 markets analyzed (a cumulated Q-o-Q increase of 3%).

Interestingly, despite only making its way into the top operators in Q4 of 2023, HQ continues its upward trajectory with the fastest portfolio expansion registered Q-o-Q with 17% more spaces among the top 25 markets and 14% nationwide. HQ now claims 91 spaces within the main markets and a total of 190 spaces nationwide.

Regus and Industrious also added more coworking spaces to their inventory, both within the leading markets and outside of them: Regus now claims 957 spaces across the U.S. (the highest number attributed to one operator) — a 4% increase in the span of three months. Industrious now has 142 spaces nationwide, translating to a 3% growth since the previous quarter. In the same way, Spaces is also on an upward trajectory nationwide (2% growth) yet decreased its presence by a minor 1% within the top 25 markets.

Lastly, WeWork is the only leading operator to register a 9% drop in its coworking portfolio in both the top 25 markets and nationally. As such, the operator lost 16 spaces through the U.S., 15 of which were in the leading markets.

Methodology

- To compile this report, we used proprietary data from CoworkingCafe to determine the number of coworking spaces per market, as well as the total square footage and the leading operators.

- The study relied solely on the listing data available on CoworkingCafe as of April 2024.

- The top 25 markets analyzed were established per our sister company Yardi Matrix and ranked based on allocated square footage.

- In terms of pricing, we looked at the national median starting prices per person per month for virtual office, open workspace and dedicated desk coworking subscriptions.

Fair Use & Redistribution

We encourage and freely grant you permission to reuse, host or repost the images in this article. When doing so, we only ask that you kindly attribute the authors by linking to CoworkingCafe.com or this page so that your readers can learn more about this project, the research behind it and its methodology.