The coworking industry in the U.S. is in a state of constant evolution, driven by the growing demand for flexible work environments. And, as more professionals seek dynamic and collaborative spaces, coworking operators are continually adapting to meet diverse needs. This rapid transformation not only enhances productivity and creativity but also fosters a sense of community among workers from various industries.

For this reason, we made it our mission to keep a close eye on the coworking sector’s evolution and growth to help users and operators get a better grasp of the state of the industry in real-time. Specifically, in this report, we looked at the coworking space inventory, the most recent prices, the total and average square footage and the leading operators in the country’s top 25 markets, following the format from Q1 of 2024.

National Coworking Supply Grows by Another 7% in Q2, With Even Higher Surges in Indianapolis & Nashville

The total number of coworking spaces at the end of Q2 surpassed the 7,000 mark to reach 7,041 spaces. This equates to 444 more locations than at the end of Q1, which shows a constant, positive evolution of the coworking sector across the nation. Furthermore, after a 6% growth in inventory in Q1, the U.S. continued to add more coworking spaces and grew by another 7% by the end of the second quarter.

Almost all of the leading markets increased their coworking inventory with surges of up to 9% in Indianapolis — which now stands at 76 spaces — and 8% in Nashville, which ended the second quarter with 90 flex workspaces.

Moreover, in Q2, only two of the leading 25 markets decreased their coworking inventory: San Francisco dropped one space and Brooklyn lost two. Even so, they both still logged a healthy supply of 120 and 80 flex workspaces, respectively.

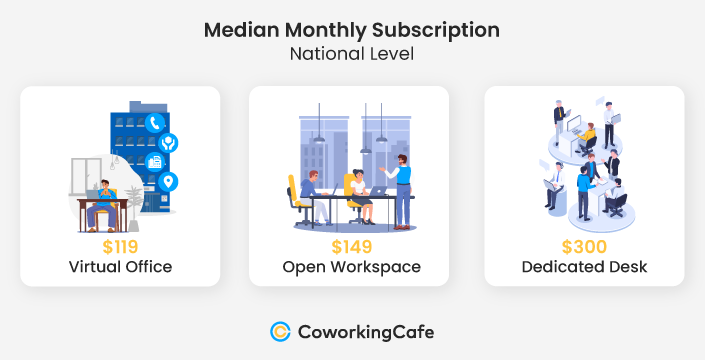

Rates for Virtual Offices & Open Workspaces Remain Stable, Dedicated Desks Go Down in Price

Coworking prices in Q2 remained generally stable with virtual offices maintaining the same rate ($119) as in the first quarter of the year and open workspaces dropping $1 overall to $149. Meanwhile, dedicated desks saw a moderate price drop of $9 quarter-over-quarter to a current monthly median of $300.

Virtual Offices

Washington, D.C. continued to log the lowest rate for virtual offices in the nation at only $80 per month, while, perhaps surprisingly, Manhattan was another market to finish below the $100 mark in this category at a monthly median of $99 (on par with Denver). Notably, the most significant price drop in Q2 was observed in Seattle, which decreased by $35 to end at $154 per month, while Atlanta also went down in price by a significant $28 to $148 per month at the end of Q2.

At the other end of the spectrum, virtual offices in New Jersey and Orange County, CA, were the most expensive in the country at $205 and $179, respectively. In fact, Orange County registered a $20 price increase quarter-over-quarter from the previous monthly rate of $159.

Open Workspaces

Interestingly, open workspaces are still significantly higher than the national rate in markets such as Manhattan and San Francisco, both of which logged monthly medians of $299. That said, the highest price increases in this category were registered in Texas markets: Dallas-Fort Worth went from $150 per month in Q1 to $198 per month at the end of Q2, while Houston rose from $150 to $175 per month. Conversely, at only $119 per month, other markets — like New Jersey, Phoenix and Salt Lake City — boasted more affordable rates for open workspaces than the national median.

At the same time, Denver and Seattle saw the biggest drops in open workspace prices: Denver went down $26 in the span of one quarter and Seattle decreased by $24.

Dedicated Desks

Interestingly, dedicated desks in Manhattan, San Diego and Austin, Texas, far surpassed the national median of $300: While San Diego and Austin both logged a monthly rate of $400, Manhattan was the only market to exceed $500 at $520 per month, which was $10 more than in Q1. The same price increase was registered in Minneapolis-St. Paul, where the $360-per-month dedicated desks were also higher than the national rate.

At the opposite pole, the most affordable dedicated desks in the country were found in Indianapolis ($209), as well as Chicago and Raleigh-Durham, NC ($259). Some markets even saw significant price drops in Q2 of 2024. That included a decline of $25 in Washington, D.C. — now standing at a monthly median of $340 — and a drop of $24 in Boston, which fell from $399 in Q1 to $375 most recently.

Leading Markets by Number of Coworking Spaces

LA Continues to Lead Nation; Dallas-Fort Worth Surpasses Previous Runner-Up, Manhattan, for 1st Time

In the previous two quarters, Los Angeles was closely followed by Manhattan in terms of the number of coworking spaces. But, in Q2, there was a significant shift on the podium. Now, LA still leads with 279 spaces after 3% growth (up from 270 spaces in Q1), but the runner-up position is held by Dallas-Fort Worth. In this case, the market’s coworking inventory increased by 5% in Q2 to rise from 259 spaces to 271 — more than Manhattan’s location count of 264. In fact, in the second quarter of this year, Manhattan had the lowest registered increase in inventory after adding just one coworking space in the last three months.

Just outside of the podium, Washington, D.C. came in fourth place with a total of 258 coworking spaces after a 5% surge, while Chicago and Denver were just behind with 243 and 227 flex workspaces, respectively, after increases of 3% and 4%. All three of these markets maintained their positions from the previous quarter after growing their inventory.

But, the most significant rises in coworking space supply in Q2 were seen in Indianapolis (9%) and Nashville, TN (8%), as well as in Philadelphia and Salt Lake City, both of which grew their total location count by 6%. Not to be outdone, Atlanta, New Jersey and Austin all registered 5% increases in inventory. The only market with completely stagnate activity this quarter was Boston, which remained at 202 coworking spaces.

Leading Markets by Square Footage

Nearly 2.9M Square Feet Added to National Inventory as 70% of Top Markets Gain Coworking Ground

On a national level, the total square footage attributed to coworking spaces grew by another 2% in the last quarter. It now claims a total of 127,671,340 square feet, which makes it easy to see the ongoing development of coworking across the nation. What’s more, the current total square footage represents 1.8% of the total office space in the U.S.

During the second quarter, 18 of the top 25 markets logged increases in their total coworking square footage. In particular, Indianapolis led with an impressive 9% rise in coworking surface to reach 1.68 million square feet of coworking spaces and continue its growth as seen in Q1. Following behind with an 8% rise was Brooklyn, where 2.36 million square feet now belong to flex workspaces. Next in line was the Dallas-Fort Worth area with 5% more coworking surface covered in Q2 to claim an impressive 5.37 million square feet. Similarly, the same 5% growth was seen in Salt Lake City, which put the market at a total of 1.68 million square feet at the end of Q2.

Conversely, seven areas lost coworking ground in Q1. The most significant decrease (-11%) was registered in the Bay Area, which still rests at a healthy 2.61 million square feet. Apart from that, the remaining drops in the total coworking surface ranged from just -0.3% in Atlanta to -5% in Manhattan and Seattle.

Speaking of Manhattan, despite losing 5% of its coworking surface and claiming fewer spaces than LA and now Dallas-Fort Worth, the Big Apple still led in terms of coworking surface with a remarkable 11.89 million square feet — almost double that of the runner-up, Los Angeles, where the coworking space inventory covers 6.5 million square feet. Chicago followed with the third-highest square footage of coworking at 6.33 million to surpass the previous third-largest market, Washington, D.C., which now stands in fourth position with 6.18 million square feet of coworking spaces.

Majority of Markets Continue to Decrease in Average Space Size, but Brooklyn Gains 10% in Average Square Footage

While the total national square footage continues to grow, the average square footage of individual coworking spaces in most markets is declining, following last quarter’s trend. As such, in Q2, the national average square footage registered a 4% decrease compared to the previous quarter, dropping 784 square feet to land at 18,133. More precisely, 18 of the top 25 markets saw decreases in the average coworking space size. However, given that the total coworking inventory — as well as the total square footage — is on the rise in most markets, this average only highlights the smaller coworking spaces across the nation.

Despite declining by 6%, the leading market in terms of average square footage was still Manhattan, which boasted the largest coworking spaces at 45,023 square feet. The previous runner-up, San Francisco, then fell to third place. It was overtaken by Manhattan’s neighboring borough, Brooklyn, which had an average coworking surface of 29,452 square feet after an impressive 10% growth from Q1. At the same time, San Francisco lost 4% of the surface attributed to its flex workspace inventory to land at an average of 26,944 square feet per coworking space.

Otherwise, the most significant drop in average square footage was seen in the Bay Area, which decreased by 12% in the span of just three months, going from 23,796 square feet to 21,023. Other significant decreases were logged in Seattle (6%) and Atlanta (5%), whereas the highest surges in average square footage (apart from Brooklyn) only reached 1% in Indianapolis and New Jersey. While both of these markets gained coworking spaces in Q2, the fact that they dropped in average square footage highlights the closure of larger spaces and the rising interest for smaller ones.

Distribution of Top Coworking Operators

Leading Operators Add 39 More Spaces Nationwide With HQ Continuing to Grow by Another 13%

The top leading coworking operators in the U.S. market remained the same as they were in Q1 of 2024 — Regus, WeWork, Industrious, Spaces and HQ. All of them logged the highest numbers of coworking spaces both on a national level (a cumulated, quarter-over-quarter increase of 2%) and within the top 25 markets analyzed (a cumulated, quarter-over-quarter increase of 1%).

First, although HQ only made the top five leading operators in the last quarter of 2024, it continues to rapidly expand its portfolio and grow significantly quarter-over-quarter. With that, the operator solidified its fifth position by adding nine more spaces among the top 25 markets (for 10% growth) and 24 nationwide, accounting for an impressive 13% increase in inventory.

Meanwhile, the leading U.S. operator, Regus, saw a slight uptick of 2% in its portfolio, both nationally (now reaching a total of 980 spaces) and among the top markets (572 spaces). This was also the same growth as Industrious, which now has 145 locations across the country, 130 of which are in the leading 25 markets. And, although Spaces opened three more spaces this quarter, all of these are located outside of the leading markets, which translates into a 2% growth in total location count.

Runner-up WeWork was the only operator to register drops in inventory of 8% among the top markets and nationwide. Even so, WeWork still claimed a high number of coworking locations for a total of 158, of which 17 are found in the main coworking markets.

What the Experts Say

What are the main factors that are driving the constant growth of the coworking sector across de nation?

Doug Ressler, Business Intelligence Manager - Yardi Matrix:

"The coworking sector has been experiencing significant growth due to several key factors:

The move to integrate a hybrid model (work-from-home (WFH) and coworking) approach suggests that, in the long run, businesses adapt to the new way that work is performed. At the same time, the increase in remote work has led many professionals to seek flexible and networking workspaces outside of traditional offices. Coworking spaces foster a sense of community and collaboration, which can lead to increased productivity and innovation."

Peter Kolaczynski, Director of Data & Research - Commercial Edge:

"As the workers' relationship with the office continues to evolve, individuals and corporations have agreed that there is a need for flexibility within a company's space footprint. As this demand further ingrains itself in the marketplace, the demand will be met by operators."

With Dallas-Fort Worth surpassing Manhattan this quarter and getting close to the current leader - LA -, what would you say is drawing operators to the DFW market more so than Manhattan and LA?

Doug Ressler, Business Intelligence Manager - Yardi Matrix:

"Dallas-Fort Worth (DFW) has become an attractive market for operators for several reasons which support equilibrium:

- Strategic Location: DFW’s central location in the U.S. makes it a prime hub for both domestic and international travel. This central positioning allows for efficient connectivity and logistics.

- Economic Growth: The DFW area has experienced significant economic growth, with a robust job market and a favorable business climate. This growth attracts businesses and talent, creating a thriving ecosystem.

- Flexible Office Space: DFW ranks high in terms of flexible office space availability, which is crucial for businesses adapting to new work models post-pandemic."

Peter Kolaczynski, Director of Data & Research - CommercialEdge:

"This a continuation in our belief that coworking operators are bringing the office to the employees (suburbs) rather than the employee commuting to the office. We continue to see growth in DFW’s desirable suburban communities."

Methodology

- To compile this report, we used proprietary data from CoworkingCafe to determine the number of coworking spaces per market, as well as the total square footage and the leading operators.

- The study relied solely on the listing data available on CoworkingCafe as of June 2024.

- The top 25 markets analyzed were established per our sister company Yardi Matrix and were ranked based on allocated square footage.

- In terms of pricing, we looked at the national median starting prices per person per month for virtual office, open workspace and dedicated desk coworking subscriptions.

Fair Use & Redistribution

We encourage and freely grant you permission to reuse, host or repost the images in this article. When doing so, we only ask that you kindly attribute the authors by linking to CoworkingCafe.com or this page so that your readers can learn more about this project, the research behind it and its methodology.