Key Takeaways

- In 96% of the cities analyzed, coworking was more affordable than office leasing.

- Coworking subscriptions cost less than half the price of an office lease in 17 U.S. cities.

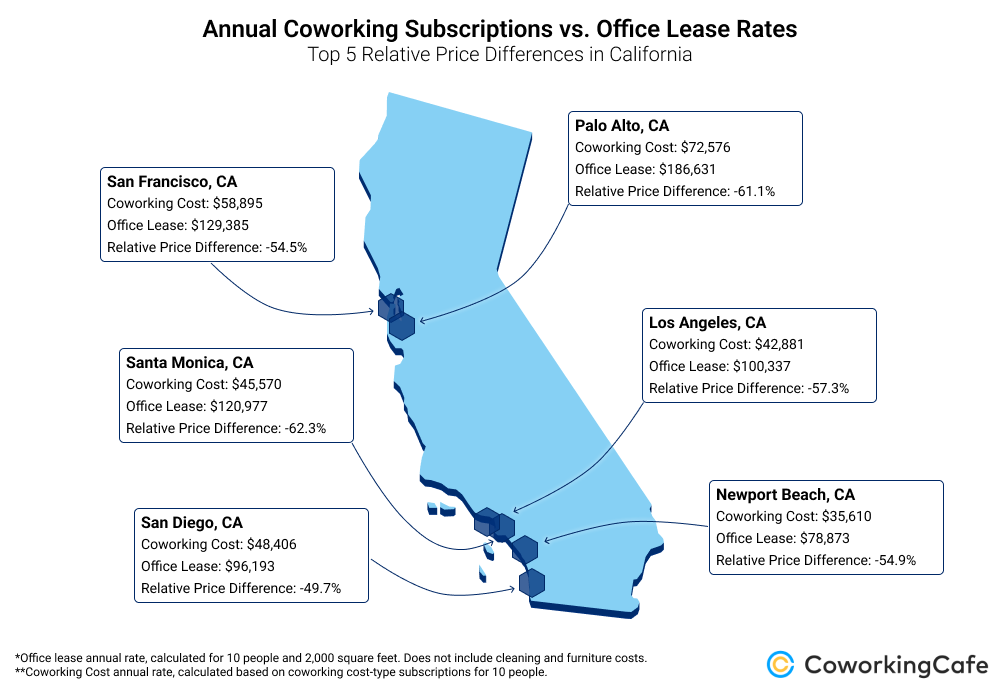

- The widest price gap was registered in Santa Monica, CA, where coworking was at a 62% discount compared to traditional office space.

- Kansas City, MO had the smallest price difference: the balance tipped less than 1% in favor of coworking spaces.

- Office leases represented the best deal in Cincinnati, OH, where they were 11% cheaper than the average coworking subscription.

Workspace flexibility is becoming a hard requirement to stay in the game — especially for small and mid-sized companies. The agility to dodge any sudden changes that might put work efficiency at risk is no longer just a nice-to-have.

Coworking memberships were rarely (if ever) considered a serious contender for traditional office leases. However, the inherent flexibility that makes subscription-based office access so appealing to freelancers is proving to be a useful asset for businesses of all sizes, especially at times of vigorous growth or restructuring. Furthermore, coworking memberships are also offered to help employees diversify their routine and bridge the shortcomings of remote work. Plus, flex offices have also been known to serve as the birthplace and first home of startups, non-profits and countless other initiatives, too.

By the looks of it, then, coworking spaces do offer the level of flexibility that businesses need to buffer out most bumps in the road and ease the growing pains for newcomers. But, is their adoption sustainable in the long run? Does coworking have the cost benefits to match its flexibility? And, most important, is a simple coworking subscription a viable alternative to the classic office lease?

Coworking Goes For Less Than Half the Price of an Office Lease in 1 in Every 10 Cities

To set up our ranking, we compared the prices of traditional office leases and coworking space subscriptions along the hypothetical scenario of a team of 10 — taking the average price for 10 dedicated desks or 2,000 feet of leased office space, projected over a one-year period.

Out of the 146 U.S. cities eligible for this analysis, the balance tipped toward coworking spaces as the more affordable option in all but six cities, meaning that if we look at average prices, coworking is not just more flexible but also more cost-effective in 96% of the cities in the study. Furthermore, coworking subscriptions cost less than half the price of an office lease in 17 U.S. cities.

Take a look at the top 20 cities where coworking subscriptions were the most affordable compared to office lease rates:

The context that led us to using the price of dedicated desk for our comparison is that these provide a standardized comparison point. That said, private office subscriptions are often even more cost-efficient and provide added privacy and customization, but they vary widely in size, making their prices difficult to compare between locations. Additionally, further discounts may also be available for longer-term memberships signed in advance, which our analysis did not take into account.

Regarding the size of our hypothetical team, a recent CBRE report showed that the common demand for flexible office space is around 10 seats or fewer, and the survey also found a significant growth in demand for up to 50 seats — also arguing that it’s the shared amenities that push prices to a level that small teams almost always find more affordable, suggesting that coworking could be a no-brainer for companies with 50 employees or less, as well as larger businesses with distributed workforces.

Additionally, it’s also important to take into account when making such comparisons that cleaning service fees for traditional offices average more than $11,000 per year for a 2,000-square-foot office. Furthermore, furnishing the office for 10 people would also add a one-time cost of roughly $6,600 for desks and chairs. However, both of these additional costs are included in a coworking membership.

1. Western U.S.

Renowned for its innovation-driven cities where both technology and culture thrive, California dominated the top of the list. Specifically, within the state, the coworking sector in the greater Los Angeles area presented the most attractive counteroffer overall. However, the financial advantage of coworking was equally evident in other parts of the Golden State, including Silicon Valley, the Bay Area and SoCal.

Greater Los Angeles

In Santa Monica, CA, the numbers speak volumes: with dedicated desks for a team of 10 costing almost $46,000 per year, on average, the coworking option seemed enticingly affordable compared to the traditional office lease rates that reached $121,000, which would result in more than $75,000 in annual savings. This record 62% relative price difference made Santa Monica the best city in the U.S. to swap an office lease for a coworking subscription — at least from a financial point of view.

Next, Los Angeles, CA just missed the podium. Here, the 57% discount earned the city fourth place in the national ranking with a $57,000 annual savings for 10 desks compared to the equivalent space obtained through a traditional lease. LA was followed by Newport Beach, CA in sixth place with a similar 55% discount, which amounted to “just” $43,000 in savings per year due to the lower overall price level.

From other parts of the metro area, Culver City, CA and Beverly Hills, CA made the top 20 with 52% and 50% discounts, respectively.

Silicon Valley

Silicon Valley

Although the price of the baseline 2,000 square feet reached by far the highest in Palo Alto, CA, close to $187,000, the Silicon Valley powerhouse still secured second place when ranking the cities by the relative price difference. More precisely, taking the subscription-based route here would cost, on average, 61% less, unlocking a staggering $114,000 in annual savings for the hypothetical team of 10.

Further down the list, Santa Clara, CA boasted a 54% discount to secure 10th place on the national leaderboard. At the same time, San Jose, CA came in at #31 with a 47% relative difference, making the financial advantage clear for coworking throughout Silicon Valley.

San Francisco Bay Area

Coworking was a similarly attractive alternative in the Bay Area, too. Namely, San Francisco, CA set the pace with a 54% discount from the average office lease rate to land in seventh place. Meanwhile, San Mateo, CA followed suit at #11 with the same degree of relative price difference, but a roughly $2,500 smaller annual savings: moving a team of 10 from a traditional office into a coworking space equated to a potential $68,000 annual savings in San Mateo and more than $70,000 in San Francisco.

Southern California

From southern California, San Diego, CA rounded out the top 10% with coworking subscription prices averaging exactly half the mean annual lease rate for traditional office space. Here, the annual savings for the 10-person team reached almost $48,000. By comparison, neighboring Carlsbad, CA boasted a savings of more than $32,000, or 45% off the annual sum of a typical office lease.

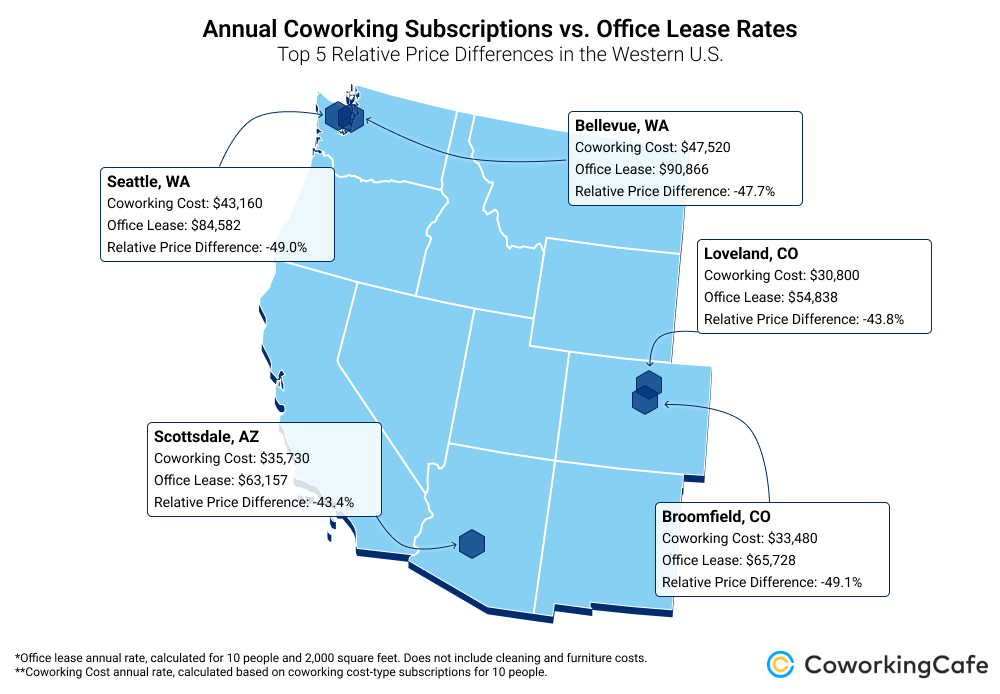

Western Cities Outside California

In addition to the hot California coworking markets, several other Western cities also offered enticing coworking options. Broomfield, CO boasted the most attractive discount outside of California at 49%, adding up to more than $32,000 throughout a year for 10 employees and landing the Denver suburb in 18th place overall. And, rounding out the top 20 was Seattle, WA, where the average dedicated desk subscription also came in at a 49% relative price difference — more than $41,000 below the average cost of a traditional office option.

Not to be outdone, Seattle’s neighbor — Bellevue, WA — had a somewhat higher price point for both options. Moreover, the gap was also wider. Therefore, a decision to move a small team to a coworking space here would save more than $43,000. However, the proportions remained similar: coworking was 48% cheaper here, landing Bellevue just a few places behind Seattle at #26.

Not to be outdone, Seattle’s neighbor — Bellevue, WA — had a somewhat higher price point for both options. Moreover, the gap was also wider. Therefore, a decision to move a small team to a coworking space here would save more than $43,000. However, the proportions remained similar: coworking was 48% cheaper here, landing Bellevue just a few places behind Seattle at #26.

Loveland, CO and Scottsdale, AZ took fourth and fifth places, respectively, in the western list and were also neck-and-neck in the national ranking at the 37th and 38th places. And, although Loveland’s discount of $24,000 lagged behind Scottsdale’s $27,000 price difference, Loveland’s deal was slightly better in relative terms (a 44% advantage, compared to Scottsdale’s 43%).

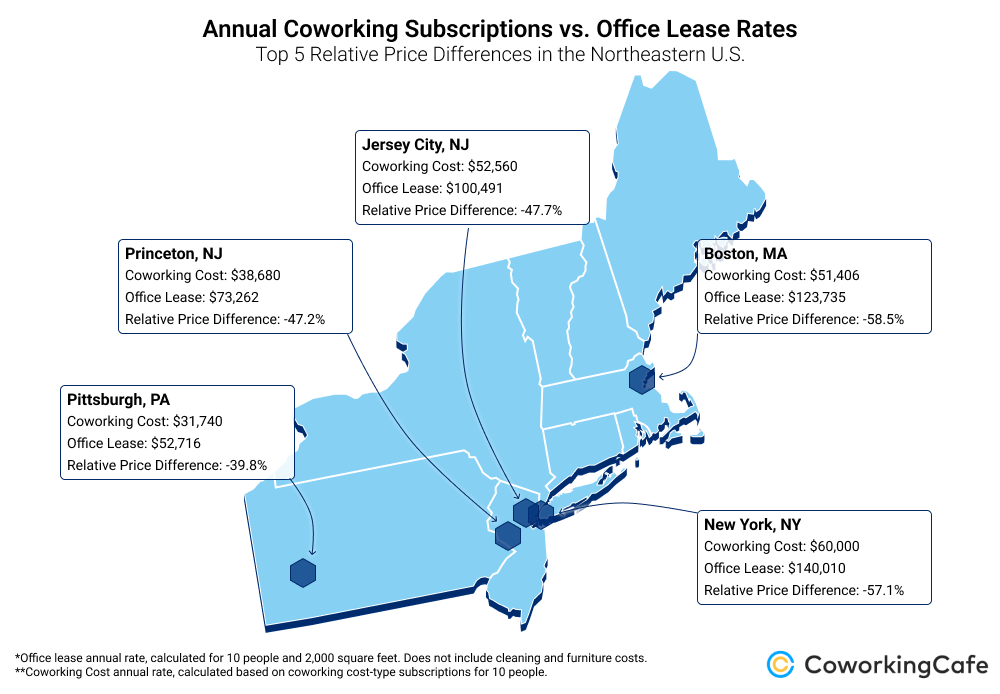

2. Northeastern U.S.

The Northeastern U.S. also presented a dynamic landscape where coworking emerged as a financially favorable choice, at least in most cities. Specifically, Boston, MA and New York City led the Northeast with significant savings in third and fifth places, respectively, echoing the nationwide trend. In Boston, coworking prices stood at a 58% discount compared to traditional office leases, leading to more than $72,000 in average annual savings for a 10-strong team. Likewise, New York showcased a 57% discount with annual savings of $80,000 in the same setting.

Due to the exceptional dominance of Western markets in the top of our list, the third Northeastern city — Jersey City, N.J. — fell all the way back to #27. However, this shouldn’t discourage entrepreneurs from exploring the coworking option, as the nearly $48,000 in annual savings is still a great deal. As a matter of fact, the 48% relative difference put the city in the same league as Bellevue, WA.

Due to the exceptional dominance of Western markets in the top of our list, the third Northeastern city — Jersey City, N.J. — fell all the way back to #27. However, this shouldn’t discourage entrepreneurs from exploring the coworking option, as the nearly $48,000 in annual savings is still a great deal. As a matter of fact, the 48% relative difference put the city in the same league as Bellevue, WA.

Similarly, another New Jersey market — Princeton, N.J. — followed closely at #29 with a 47% discount, leading to nearly $35,000 in annual savings. Finally, Pittsburgh, PA rounded out the Northeastern top five, demonstrating a 40% discount and just shy of $21,000 in potential annual savings.

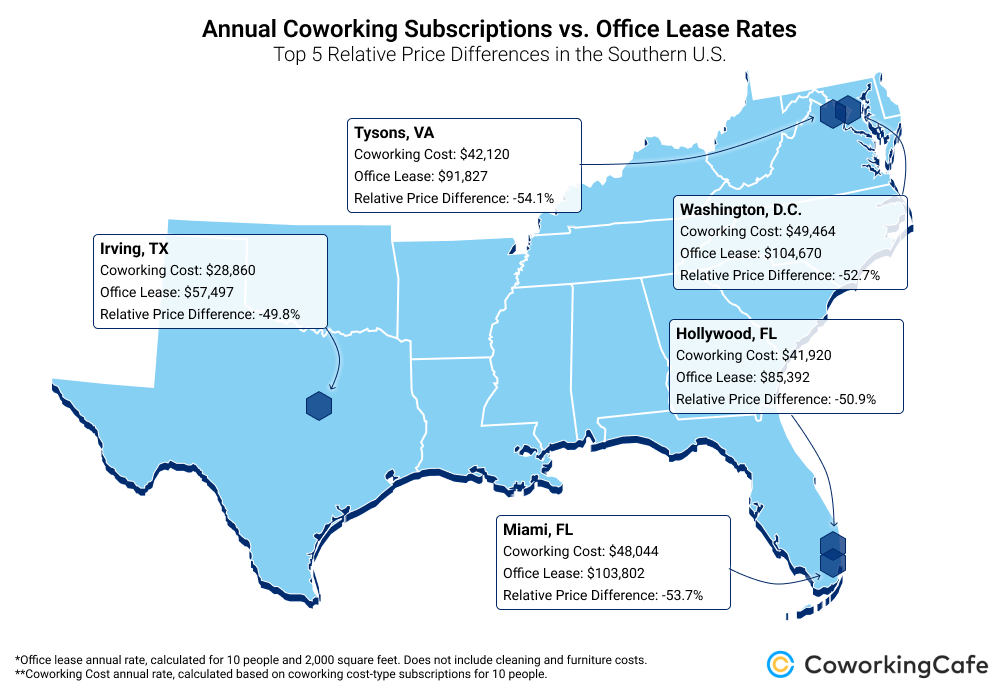

3. Southern U.S.

Cities like Tysons, VA and Miami, FL clearly demonstrated the financial appeal of coworking in the South, too. For instance, businesses in Tysons would enjoy a 54% discount and an annual savings of almost $50,000, earning the Virginia city eighth place. Along the same lines, Miami offered a 53% relative price difference at #9 to provide an even more substantial $56,000 in yearly savings.

Washington, D.C. was next on the Southern leaderboard (landing in 12th place nationally) with a 53% discount, allowing businesses to save more than $55,000 annually, on average. In the same vein, Hollywood, FL offered the fourth-most attractive discount (51%) and an annual savings well over $43,000.

Washington, D.C. was next on the Southern leaderboard (landing in 12th place nationally) with a 53% discount, allowing businesses to save more than $55,000 annually, on average. In the same vein, Hollywood, FL offered the fourth-most attractive discount (51%) and an annual savings well over $43,000.

Lastly, Irving, TX also deserves a mention not just because of the potential annual savings of nearly $29,000, but also because the 50% relative price difference pushed the Texas city into the national top 20 to take 16th place, despite the strong grip of Western markets.

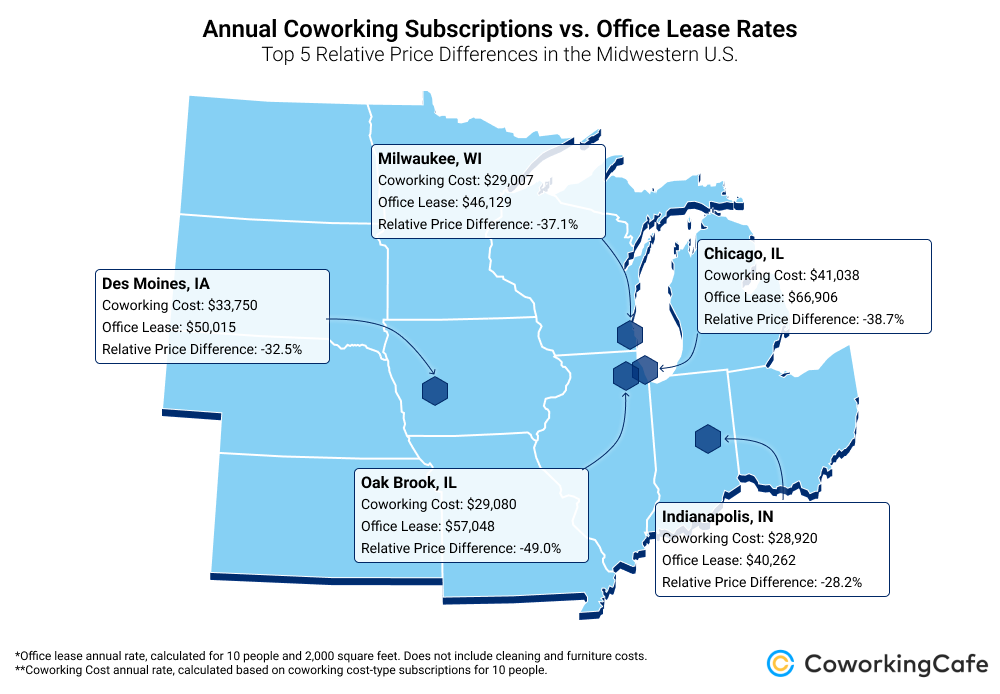

4. Midwestern U.S.

In the Midwest, prices were generally more balanced than in other regions. Yet, that’s not to say that there weren’t any similarly polarized cities. As an example, in Oak Brook, IL, coworking subscriptions still came in at about half the price of a similar traditional office setup. To be exact, an average dedicated desk subscription for 10 people would cost 49% less than the equivalent office lease, amounting to almost $28,000 in annual savings. This earned Oak Brook 19th place in the national ranking.

Meanwhile, Chicago, IL, offered a 39% relative price difference, resulting in substantial yearly savings of nearly $26,000. However, despite coming in second in the Midwest, Chicago was actually more in the middle of the pack in the national overview in 49th place.

Meanwhile, Chicago, IL, offered a 39% relative price difference, resulting in substantial yearly savings of nearly $26,000. However, despite coming in second in the Midwest, Chicago was actually more in the middle of the pack in the national overview in 49th place.

Notable Excepions: Cities Where Lease Rates Outprice Coworking Subscriptions

While coworking clearly proved to be more advantageous in the majority of the cities we analyzed, some areas presented a different dynamic. In fact, in select cities, office leasing emerged as the more financially sound choice.

In particular, Cincinnati, OH and New Orleans, LA were prominent in that they were the only two cities where the discount — in favor of office leasing this time — reached double digits at 11% and 10%, respectively. Even so, the pendulum did not swing as high in this direction in terms of the actual savings either, reaching only about $4,000 in both cities.

Tucson, AZ also followed suit, favoring office leasing with a 9% discount compared to coworking. Here, businesses could save north of $3,000 per year for a team of 10 by choosing a traditional office space.

Next in line were Albany, N.Y. and Franklin, TN, both of which clocked in at 7%. However, this would offer businesses in Franklin an annual savings of close to $5,000, compared to just over $3,000 for those in Albany.

Office leasing emerged as the more financially prudent choice in Memphis, TN as well, which had a 5% discount compared to coworking. This equated to annual savings of a hair above $2,000 for a team of 10.

Although technically past the tipping point, Kansas City, MO is worth mentioning here, as it registered the smallest price difference. Both the average annual coworking membership for 10 people and the average lease for 2,000 square feet of office space hovered around the $39,000 mark, bending less than 1% in favor of coworking spaces.

While these cities demonstrated a dynamic in which office leasing took the lead, with unique cost structures and market conditions contributing to this alternative trend, it’s essential to note that coworking still remains the more favorable choice in the vast majority of cases. Additionally, remember that when accounting for additional costs — like cleaning fees and furniture expenses — these thin margins simply dissolve.

Final Thoughts

While the pandemic felt like a sudden and not-at-all smooth turn toward a future with more innate flexibility, the turn signal had actually been blinking long before 2020. And, although it may feel like the world is now past the apex of this difficult corner, there could be plenty of bumps to absorb in the near term, as well — if what we’ve seen of the “new normal” thus far is anything to go by. In particular, the continued rise of project-based collaborations, the increasing desire for better work/life balance, and, more recently, the mass layoffs in the tech industry are all signs that the world is not in the home stretch just yet.

All of these trends point to one fact, though: the demand for workspace flexibility is here to stay — at least for now — and companies will remain incentivized to diversify their office assets and be open to more adaptable solutions. And it shouldn’t be difficult to stay open as long as shared amenities make coworking prices so appealing for small companies.

As our data revealed, the coworking sector in some U.S. cities is better positioned to capitalize on this trend than it is in others. And, while the future remains uncertain, it’s important to note that pronounced imbalances (like the one this study uncovered) often pave the way for transformative developments. As with any situation with this degree of polarity, these discrepancies too will likely set the stage for exciting trends moving forward.

Methodology

- To compare the costs of coworking and office leasing, we analyzed the prices of dedicated desk packages and average office lease rates in 146 U.S. cities.

- The analysis utilized proprietary CoworkingCafe listing data for coworking costs and the CommercialEdge database for office lease rates, both of which were extracted on August 1st, 2023.

- Cities with less than three different dedicated desk price points or no data for any of the other metrics were excluded from the analysis.

- The base line for both scenarios was a team of 10 people.

- For traditional offices, 2,000 square feet of office space was used for the calculations and multiplied by the average office lease rate per square foot.

- For coworking space prices, average per-person prices of dedicated desk packages were used due to the subscription type’s wide availability across different coworking space operators and the uniformity of the services and benefits they include.

- Cleaning fees and furniture costs were not included in the calculations.

Fair Use & Redistribution

We encourage you and freely grant you permission to reuse, host, or repost the images in this article. When doing so, we only ask that you kindly attribute the authors by linking to CoworkingCafe.com or this page, so that your readers can learn more about this project, the research behind it and its methodology.